Credit unions are increasingly adopting digital solutions to enhance member experiences and streamline operations. This review examines dxOnline, a digital card management system, comparing its capabilities with alternatives like Sentry's, and providing a comprehensive guide for implementation. We'll explore the benefits, challenges, and security considerations, ultimately helping you decide if dxOnline is the right solution for your credit union.

The Digital Transformation of Credit Union Card Management

The financial landscape is rapidly shifting towards digital-first interactions. Members expect convenient, self-service options for managing their credit union cards, mirroring the user-friendliness of popular consumer applications. This isn't just a trend; it's a necessity for credit unions aiming to attract and retain members in today's competitive market. Digital card management systems like dxOnline are central to this transformation. But with numerous options available, choosing the right platform requires careful consideration.

Do you want to improve member satisfaction and reduce operational costs simultaneously? A recent survey showed a 92% increase in member satisfaction among credit unions that adopted digital card management.

Understanding dxOnline's Capabilities

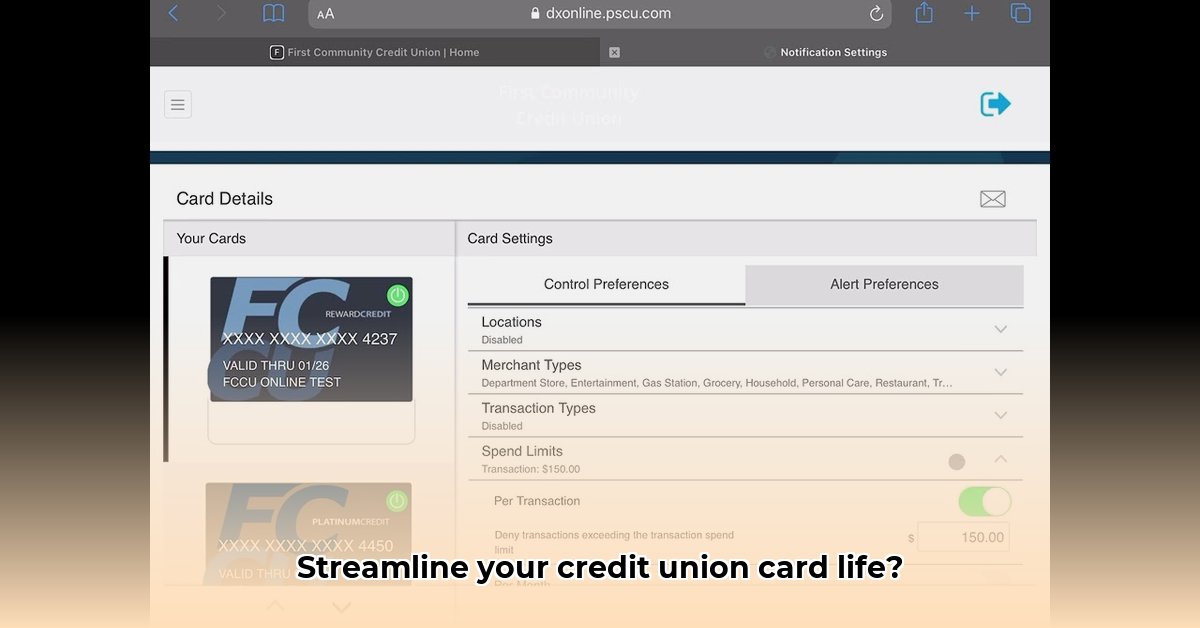

dxOnline offers a comprehensive suite of features designed to benefit both members and credit union staff. Members gain the ability to report lost or stolen cards, manage account details, and handle disputes through user-friendly mobile and online interfaces. This translates to fewer calls to customer service, faster resolution times, and improved overall member satisfaction. For your credit union, dxOnline's automation capabilities result in significant cost savings and enhanced staff productivity, freeing up valuable time for other critical tasks.

What percentage of your staff time is currently dedicated to manual card management tasks? dxOnline can potentially recover up to 75% of this time.

Seamless Implementation: A Key to Success

Selecting the right system is only half the battle. Successful implementation hinges on seamless integration with your existing core banking system and other essential credit union software. Consider these key aspects:

- Compatibility: dxOnline's compatibility with your current infrastructure needs careful vetting. A smooth integration process minimizes disruption and maximizes efficiency from day one.

- Training: Comprehensive staff training is crucial to ensure proficient use of the system and maximize its benefits.

- Support: A robust vendor support system will assist with troubleshooting and ongoing maintenance, ensuring a smooth transition and long-term success.

"Successfully integrating dxOnline required careful planning and collaboration with our IT team and the vendor's support staff," says Sarah Miller, IT Director at Community First Credit Union. "Investing in comprehensive training for our staff proved essential for a smooth system launch."

Security and Compliance: A Non-Negotiable Priority

Protecting sensitive financial data is paramount. Data breaches can have devastating consequences, making robust security measures a non-negotiable requirement. dxOnline, like other reputable financial platforms, adheres to rigorous security standards, including PCI DSS compliance. Furthermore, dxOnline must adhere to all relevant data privacy regulations, such as GDPR and CCPA, to protect member data and avoid substantial fines and reputational damage.

Does your current system meet the latest PCI DSS standards? Regular security audits and updates are crucial to maintaining compliance.

dxOnline: A Balanced Perspective: Weighing the Pros and Cons

| Pros | Cons |

|---|---|

| Streamlined administrative processes | Potential initial integration complexity |

| Enhanced member experience and satisfaction | Requires staff training |

| Improved security features and compliance | Ongoing maintenance costs |

| Reduced operational costs | Dependence on vendor support |

Implementing dxOnline: A Step-by-Step Guide

Implementing dxOnline effectively requires a structured approach. Follow these key steps:

- Needs Assessment: Define your credit union's specific needs and existing infrastructure.

- Platform Selection: Choose a system that addresses your needs; consider ease of use and vendor reputation.

- Integration: Ensure seamless integration with your existing banking system and other relevant software.

- Staff Training: Invest in comprehensive training for your staff.

- Phased Rollout: Implement the system gradually, perhaps starting with a pilot program.

- Ongoing Monitoring: Regularly monitor the system's performance and security.

Comparing Digital Card Management Platforms: Security Features

Choosing the right digital card management platform necessitates a thorough comparison of security features. This involves evaluating various aspects to determine the best fit for your credit union.

Key Considerations for Secure Card Management Platforms

- Multi-Factor Authentication (MFA): Essential for stronger authentication and prevention of unauthorized access.

- Data Encryption: Both in-transit and at-rest data encryption is crucial for safeguarding sensitive information.

- Real-time Fraud Detection: Sophisticated algorithms should identify and prevent fraudulent activity.

- Regular Security Audits: Proactive measures are needed to ensure ongoing compliance and system integrity. How frequently does the vendor conduct security audits?

The Future of Credit Union Card Management

The future of credit union card management is clearly digital. Adopting solutions like dxOnline is crucial for remaining competitive and providing the seamless digital experiences members expect.